As we fast approach the end of the financial year, do you know if your trade business is eligible for the instant asset write off? Also, what other tax deductions are you entitled to claim to reduce your taxable income.

In order to claim tax deductions, a trade business must be able to produce proper receipts or invoices to prove any purchases and that the purchases are directly related to or required for work purposes. However, after putting in hard work to meet deadlines and reach targets, a business owner can neglect this area of the business. Therefore, it is so crucial to use a professional bookkeeper or outsourced finance department.

Below is a list of a few common expenses that tradies could be claiming back in their tax returns to save a lot of money:

Due to Covid-19 the government has introduced an immediate write for assets valued up to $150,000. This is a great incentive especially if you are a trade business owner as it includes vehicles used for business purposes. As long as the vehicle is over 1 tonne or used to carry work equipment the deduction will apply.

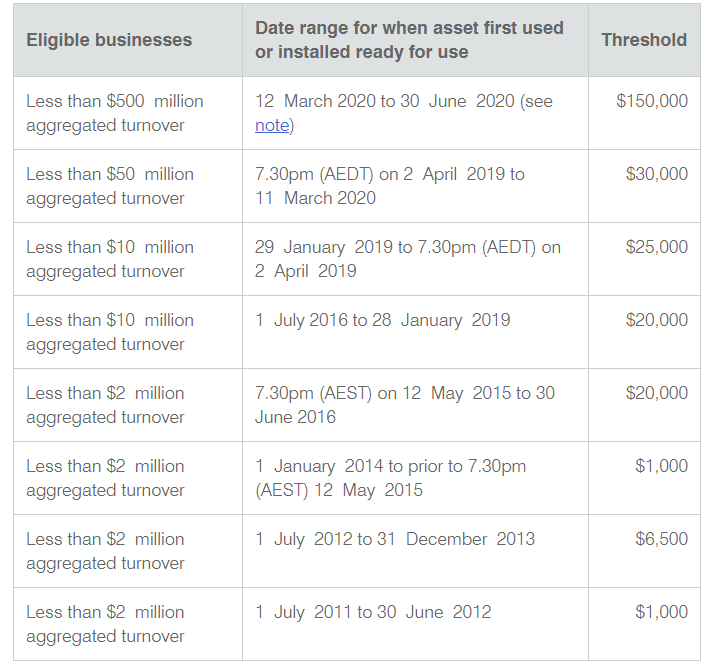

You need to talk to your accountant to make sure you meet all the eligibility for the deduction and check to make sure you keep all the documentation for compliance purposes. This is a great incentive if you are looking to reduce taxable profit. Below is a table from the ATO that lists requirements:

Other items to look at for tax deductions include:

Replacement Tools

You can claim the expenses involved in repairing or insuring your tools and equipment as well as claim any interest charged on money borrowed to purchase the items. However, if you use the tools or equipment for both work and personal use, you’ll need to show a diary that specifies how it’s used, so the deduction can be apportioned correctly.

Again, you may be eligible for an instant write off for the purchase of a lot of equipment if it relates to work purposes. Especially if you own a factory and you are looking at purchasing expensive equipment.

Protective Equipment

Safety is one of the most important aspects in the trade industry and certain protective clothing or items for your work, such as hard hats, sunglasses or steel-capped boots, can be claimed as a deduction. However, remember that you will need proof of purchase in the form of a receipt or invoice.

Professional Development

In order to stay competitive, you constantly have to master your craft and take part in courses that will help you scale. These training courses, licences or certifications you undertake to maintain or improve your skills, or that certify you to perform a task for work, are tax deductible.

Superannuation

You can also claim any extra super contributions you make against your business profit up to a certain limit. Super funds have a lower tax bracket, and this means you may be able to lower the overall amount of tax you pay if you make use of making extra contributions into your fund. You need to speak to your financial planner in conjunction with accountant to make sure this strategy is relevant to your business.

To make sure your trade business is eligible for the immediate instant asset write off and other deductibles it qualifies for consult an expert for the right guidance you need. You can contact us today for a free initial consultation!